Some of the disadvantages of having a social credit score is that having video surveillance and social media monitoring is invasive, individuals and companies have significantly less privacy, the system is open to mis-scoring and algorithmic mistakes, and there is a lack of knowledge regarding scoring which can promote corruption. Those who have low credit scores ultimately risk getting treated as second-class citizens. There are many consequences to having a low credit score. Some of the most common causes that lead to low credit scores include late payment of bills, bankruptcy filing, charge-offs, and defaulting on loans. Some other examples include things such as traffic offenses such as drunk driving or jaywalking, “illegally” protesting against the authorities, and not visiting aging parents regularly.

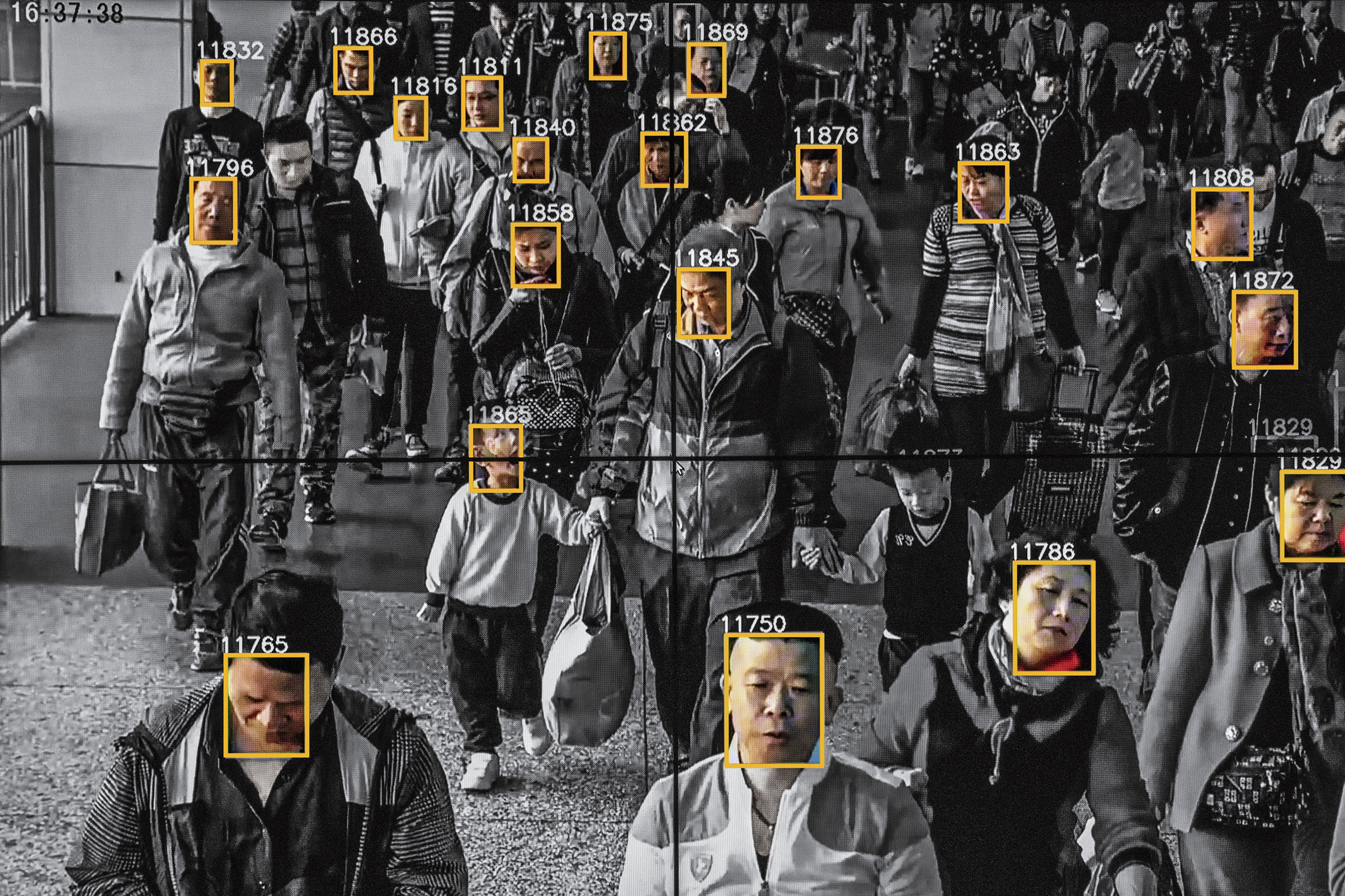

Overall, social credit scores can affect our society as a whole for many reasons. In a sense, some people argue that social credit systems encase humans because people can get easily “blacklisted” which has severe real-life consequences. When someone is “blacklisted” it means that they are out on a list, and there is no trial at court. Essentially, to get off of the list people and companies can appeal against being blacklisted or against receiving bad credit. It also impacts our entire world because we are always being stalked and tracked through every move we make, every purchase we make, and every place we visit. For example, the bank can calculate our financial credibility, interest rates, and companies such as AirBnB, and Uber can disable your account. For instance, if a homeowner or a driver reported you for ‘bad behavior’, without giving you any choice to appeal. Overall, it impacts our society because it defines people's lives by limiting their life choices and freedom, it leads to inequality, and influences people’s behavior and the way they live.

Overall, social credit scores can affect our society as a whole for many reasons. In a sense, some people argue that social credit systems encase humans because people can get easily “blacklisted” which has severe real-life consequences. When someone is “blacklisted” it means that they are out on a list, and there is no trial at court. Essentially, to get off of the list people and companies can appeal against being blacklisted or against receiving bad credit. It also impacts our entire world because we are always being stalked and tracked through every move we make, every purchase we make, and every place we visit. For example, the bank can calculate our financial credibility, interest rates, and companies such as AirBnB, and Uber can disable your account. For instance, if a homeowner or a driver reported you for ‘bad behavior’, without giving you any choice to appeal. Overall, it impacts our society because it defines people's lives by limiting their life choices and freedom, it leads to inequality, and influences people’s behavior and the way they live. Social credit scores typically begin when you start using credit, whether that’s opening your first line of credit such as a credit card or a student loan. This means that it has already affected me, and probably most of us in this class as most all of us have credit cards and are using loans for college. It affects us because our credit score is determined by the way we use that initial credit account and builds from there. It has a huge impact on our financial future and the decisions we make. For example, it affects our generation and our everyday life in many ways such as when you go to buy a house, get better interest rates on loans and credit cards, getting a job, renting an apartment, refinancing loans, buying a car, getting a cell phone, setting up utility accounts, paying for insurance, etc. Overall, Social credit scores are not only so important to know, but to also know the negatives and positives of having them, understand how to have a high credit score, and the effects that it has on our society and our everyday life.

No comments:

Post a Comment